By: Hayley Chazan

When 21-year-old Ottawa student Delaney Hoeppner moved into an apartment last September, she was excited about living on her own for the first time.

Hoeppner rented a basement unit of a house in downtown Ottawa. The rent was cheap, and the unit big.

While it seemed like the perfect first apartment for a student or young professional, the initial excitement soon wore off.

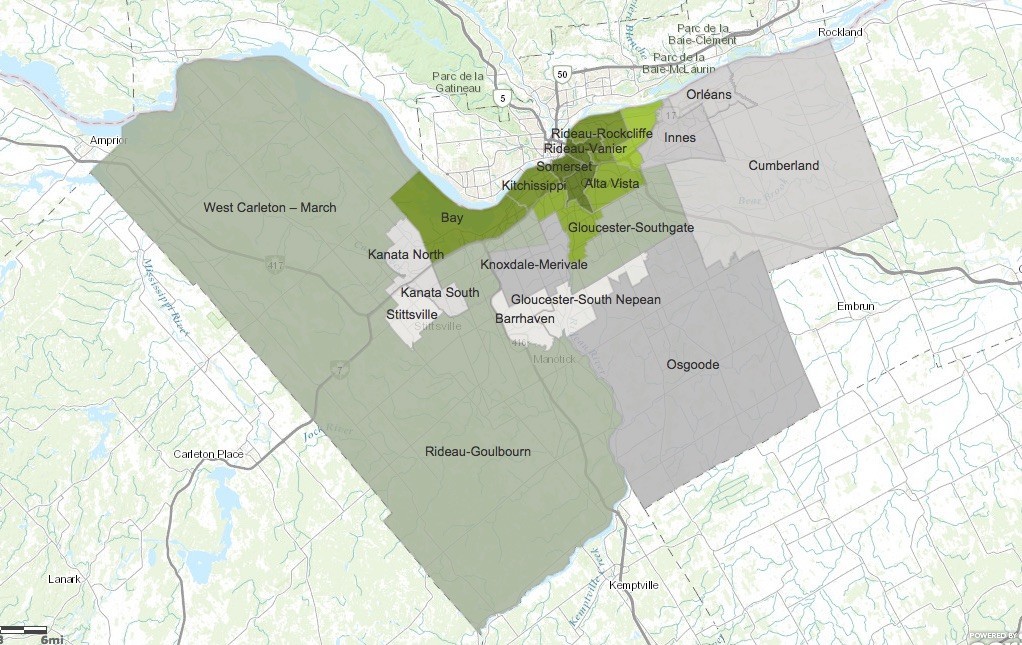

According to an analysis of Statistics Canada’s 2011 National Household Survey, the Rideau-Vanier and Somerset wards have the highest number of private residences per capita requiring major repairs in Ottawa. Renters are more at risk than homeowners to require major repairs to their dwellings.

Statistics Canada defines major repairs as dwellings with defective plumbing or wiring and dwellings needing structural repairs to doors, walls, floors and ceilings.

In Hoeppner’s case, it started with minor problems like poor water pressure in the bathroom sink. But as time went on, the repairs became more pressing.

Last winter, a problem arose with the front door that kept it from shutting completely for over two weeks.

“The apartment was freezing,” said Hoeppner.

When she finally summoned the courage to approach her landlord, she was met with resistance.

Ethienne Saint-Pierre, Executive Director of Action Logement, an organization that promotes affordable housing, said that Rideau-Vanier and Somerset wards require the most major repairs because there are a lot of small-time landlords there who can’t afford to do the work.

Nathaniel Mullin, a caseworker for Rideau-Vanier councillor Mathieu Fleury, who personally fields constituent complaints, said that while his office tries to avoid getting involved in disputes, they’ll occasionally act as a mediator if the landlord has a history of repair violations. Mullin said most of the repair problems stem from the fact that many structures are over 100 years old.

While the age of apartments in Ottawa place renters at a disadvantage, tenants also face other challenges when it comes to carrying out repairs.

The Residential Tenancies Act governs rental housing in Ontario. Landlords are responsible for maintaining and repairing rented residences. This means that renters, unlike homeowners, are unable to perform the repairs themselves and must wait for the landlord.

Tenants often end up in disputes with their landlords while attempting to address major repairs, according to Charles McDonald, Ottawa Centre’s Community Legal Services’ Executive Director.

McDonald said that if a landlord fails to perform the repairs within a reasonable timeframe, the tenant can register a complaint with the city. According to an analysis of the city’s 311 data, Rideau-Vanier and Somerset had the highest of number of complaints related to property and building codes in September 2015.

Following an inspection, the City may issue an “Order to Comply”. Failure to comply can result in the work being contracted out at the landlord’s expense or the granting of a rent reduction while the repairs remain outstanding.

This process can be lengthy, said McDonald, and it can persist longer if the landlord contests the decision.

Jean Lash, a lawyer with South Ottawa Community Legal Services, said that because of the stress that can arise out of the process, many tenants don’t confront their landlords.

“Tenants are afraid to start a conflict out of fear they’ll get evicted,” said Lash.

Nathaniel Mullin from councillor Fleury’s office said that this fear is part of the problem. He said there’s a lack of knowledge about tenant’s rights and many conflict situations could be avoided if tenants were aware of the landlord’s obligations.

Mullin said that every year, his office works with Ottawa U to provide students with information on the rules surrounding the landlord-tenant relationship.

While Delaney Hoeppner’s door was eventually fixed, the steady string of repairs during her tenancy was too much to handle.

“I saw out my one-year lease but moved home shortly after.”