Canadian Pacific Railway (CP) reported lower revenue last year, but the company’s net income increased by 18 per cent due to reduced operating costs.

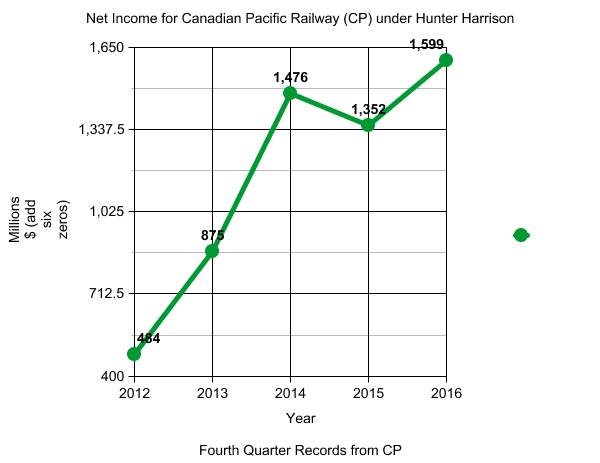

One of Canada’s largest railways, CP earned almost $1.6 billion last year after taxes compared to $1.3 billion in 2015, according to an analysis of its fourth quarter results.

Although total revenue fell seven per cent, CP lowered its operating expenses by nine per cent. This means the company became cheaper to operate and therefore increased its profit.

Some of the ways CP lowered operating costs was by reducing dwell times, meaning the time the train spent on the tracks and increasing train speed. The longer a train spends on the tracks, the higher the costs. The faster the train can get from port to station, the more money CP saves. CP trains last year also become longer and heavier.

The company also slashed jobs by 10 per cent, reducing the workforce from almost 13,000 to around 11,500 by the end of last year.

The company said in a statement last month that low operating costs helped offset “softer than expected volumes.”

Even though trains became longer, faster and heavier, there were less on the tracks in 2016.

The total amount of freight moved by CP dropped, as commodities such as oil were produced less and at a lower value. Total freight revenue fell from $6.5 to $6 billion.

The decrease in freight revenue made CP tighten its belt and streamline to remain profitable.

Retired business professor Robert Sproule, from the University of Waterloo, says that the company’s decision to slash jobs, increase train speed, and reduce dwell time had “significant” impact on their financial statement and helped offset falling revenue.

Canadian Pacific Railway Stock Prices by LiamHarrap on TradingView.com

The company’s recent success is largely due to their CEO Hunter Harrison, who took the reins at CP in 2012. According to Sproule, Harrison has been called the “Sydney Crosby” of the railroad industry, known for turning struggling companies into financial successes.

He was named “Railroader of the Year” by the Railways Age Journal and “CEO of 2007” by The Globe and Mail when he was CEO for Canadian National Railway from 2003 to 2009.

When hired at CP, Harrison said in a press release that he aimed to “cut costs, reduce train times, and lower expenses.” And it appears he has done precisely that.

Prior to Harrison’s arrival at CP, net income was decreasing yearly, from $651 million in 2010 to $484 million in 2012. Since Harrison has held the reins at CP, the company’s profit has increased by over a billion dollars. Harrison has also slashed 6,000 jobs.

Sproule says that CP has become an attractive company for investors due to the cost saving measures implemented by Harrison. Investors have seen high returns on their investments as dividend payouts rose by 26 per cent last year alone.

CP purchased over a million shares of its own stock. This has resulted in fewer shares available on the market, which contributed to driving up stock prices and dividend payouts.

Harrison announced unexpectedly last month that he would be stepping down as CEO.

CP said in an email yesterday that the “same strategy for the company will remain” under the new CEO Keith Creel. Creel will be replacing Harrison by the end of the month.

Harrison has had to forfeit almost $118 million in stock and benefit options, so he can take a job at a competing railroad company. He hasn’t indicated which company.

In a statement from CP, it was revealed that Harrison must sell his company stock by May 31.

(Too read the annotations, please click on the “Notes” tab.)