According to its 2017 First Quarter Financial Results, Canada’s largest tea boutique saw a near 10% increase in sales despite a 120% overall net income loss when compared to numbers collected the same time last year.

David’s Tea saw over 48 M in sales compared to 44M in the first quarter of 2016, with the number of stores increasing by one to reach a total of 232 locations across Canada and the United States, compared to 198 at the end of 2016.

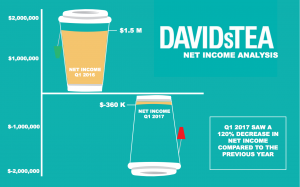

Despite the improvements in sales, the loose-leaf tea manufacturer and retailer saw a net loss of $360,000 compared to a 2016 net income of $1.5 M.

David’s Tea by mckied on TradingView.com

David’s Tea has seen its stock prices fall.

David’s Tea President and Chief Executive Officer Joel Silver, who took on the role in March 2017, referred to 2017 as a “reset year” for the company, with the drops in income related to the excess inventory across all of their stores. In a First Quarter 2017 Earnings Conference Call regarding the financial results, Silver says, “We will concentrate more in energizing the current store base,” and expects a return to normal inventory levels by the fourth quarter of 2017.

David’s Tea Chief Financial Officer Luis Borgen also addressed the excess inventory issue in the conference call, stating “Going forward we continue to plan to reduce our buy and have fewer selling seasons as we continue to work through excess inventory, and expect this will take us several quarters to work through.”

On a per store basis, David’s Tea locations have seen their inventories increased by 39% in this first quarter of 2017. There are currently plans to open five more stores during the second quarter, four in Canada and one in the US.

Silver also states the company plans to expand further into the US market, although growth in the US store base will be limited in the short term. The CEO stated, “There has been significant effort trying to penetrate the US market, while there has been some success, it has been limited. We will not abandon the US market, but we do intend to emulate the Canadian success in the US.” Currently, 80% of sales for David’s Tea are done in Canada.

David’s Tea’s cash flow related to operating activities, or the amount generated from buying and selling tea and tea accessories, saw a massive decrease from $-780,000 in 2016 to $-6.6 M the same time this year. This over seven times loss is the result of what Financial Analyst and Dalhousie Finance Professor Dr. Rick Nason refers to as “stuffing the channel.”

“When you open up your second or third store you are increasing your expenses and you are basically tripling the amount of tea or inventory you have on hand, but you’re not necessarily tripling the amount of customers,” says Nason. “Their administrative costs and their rents are growing faster than their sales, so that’s why their results are so disastrous. They’re growing faster than their customer base.”

Meanwhile, massive competitive beverage company Starbucks, which also includes David’s Tea’s main tea competitor Teavana, saw a 20% decrease in its own net operating cash flow during the same time period. Indicating the possibility that the market for tea and tea accessories is currently in a decline.

David’s Tea did not respond when contacted for comment regarding its first-quarter 2017 financial statements.